Welcome To pfireStorm

Categorizing Clients

May 1, 2014 • David Lawrence

As a financial advisor grows, the practice reaches a point in which the practitioner may wish to consider developing ways to categorize his or her clients to identify profit levels on a per client basis. Even more important is identifying service levels associated with those same clients. It simply does not make sense to offer the same level of service both to a client who has placed small amounts of investable dollars with you and to another client who has invested millions. Therefore, methods need to be devised for identifying and then carrying out service levels that match the client’s needs and are cost-efficient for the advisor.Some advisors have used a system consisting of such names as “platinum,” “gold,” “silver” and “bronze” as categories and then assigning assets under management (AUM) levels to each of those categories. However, this may not go far enough in fairly delivering services to those clients who may not exactly fall into one or another category. So how can a financial advisor develop a system of categorization that fits the unique characteristics of a diverse array of client types or service deliverables?

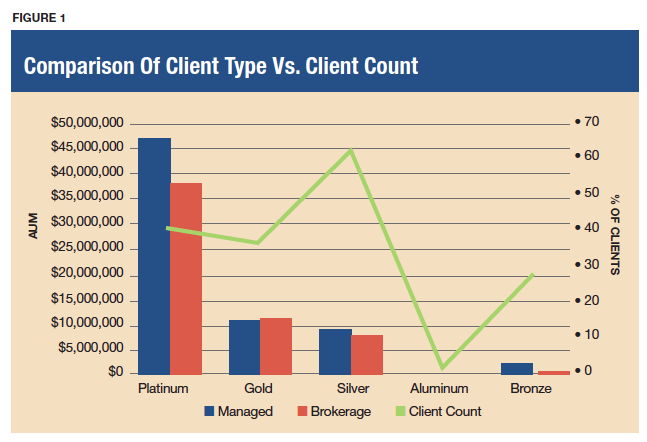

The first and most fundamental step is to analyze the client base. By creating a spreadsheet (for instance) that shows how many clients fall into different levels of AUM, fees or planning retainers, it may be possible to uncover breakpoints that can later serve as the criteria for categorization. Here is an example:

Figure 1 shows a comparison between identified client categories (platinum representing the highest AUM) and client count per category. This type of analysis can reveal some surprises. As can be seen, the silver category has the third-lowest investable asset numbers, yet has the highest client count. The platinum category, which contains the highest levels of invested assets, is barely in second place in client count. In this example, the financial advisory firm created these categories, but then split out of each category those clients who had managed accounts and separated them from those who had accounts placed through a brokerage firm (custodian).

To read more and see more examples got t0: http://www.fa-mag.com/news/categorizing-clients-17743.html?section=139

The contents of this article are sourced from third parties.There is no warranty of any kind, expressed or implied, regarding the information or any aspect of this article. We shall not be responsible for and disclaim liability for any loss, damage (whether direct or consequential) or expense of any nature whatsoever, which may be suffered as a result of, or attributable to, the use or reliance upon the information provided in this newsletter

Contact Details

| company: | pfireStorm |

| address: | 21 Alexander Drive Winston Park, Gillits |

| tel: | +27 87 474 2200 |

| fax: | +27 31 764 4090 |

| website: | https://www.pfire.co.za |

People

Company Profile

Pfirestorm is an affordable internet based service that organisations are able to offer their clients that will result in the cementing of existing relationships and/or the establishment of new relationships between the clients and the organisation.

This service is CLIENT-CENTRED and simultaneously provides the organisation with a platform that addresses fundamental business matters such as strategy and wealth creation, operations and practice management, compliance issues, day to day matters, vast Marketing opportunities, leveraging IT in a unique way, staff incentives and measurements and impact directly and indirectly on your income flows from day one.

The purpose for this service is to enable organisations and clients to be able to reach out to one another in an environment that is transparent, promotes shared responsibility and facilitates relationships providing mutual benefit for the client and the organisation.

It is no longer a matter of who you know! It is who knows YOU!

It is time!

VALUE PROPOSITION TO OUR CLIENTS

Pfirestorm’s unique collaborative technology will enable our clients to deliver a branded and unified sustainable experience to their customers at all levels of their organisation, through programmed alignment of internal procedures and processes with their Customer Value Proposition.

Our clients will experience the power of a programmed behavioral system designed to sustain, facilitate and deliver to their clients, a distinctive Customer Value Proposition resulting in increased new and retained customers that can be measured in terms of higher production outcomes, reduced operating costs, focused employee and customer activities, customer services that exceed expectations, business continuity, and ultimately good corporate governance aligned to a dynamic regulatory environment.