Welcome To pfireStorm

Financial services technology 2020 and beyond: Embracing disruption

Six priorities for 2020

1. Update your IT operating model to get ready for the ‘new normal’

By 2020, your operating model is probably going to look quite stale, even if it is serving you well today. That is because what your financial institution offers to your customers is almost certain to change, in ways both large and small. This will require important changes across, and around, the entire IT stack.

The overriding principle is that financial institutions and their IT organizations must be prepared for a world where change is constant—and where digital comes first. For this to happen, it is time to really put legacy assumptions on the table. It may appear logical to continue to support core mainframe systems, given the potential disruption and perceived cost of transition to something different. But if the existing platform could be replicated at half the cost, would the logic still apply? Or at one tenth the cost?

2. Slash costs by simplifying legacy systems, taking SaaS beyond the cloud, and adopting robotics/AI

One of the starkest differences between a legacy financial services institution and a FinTech upstart comes down to fixed assets. Incumbents carry a huge burden of IT operating costs, stemming from layer upon layer of systems and code. They have bolted on a range of one-time regulatory fixes, fraud prevention, and cyber-security efforts, too. The ever-spreading cost base leaves less budget available for capital investment into new technology, driving a vicious cycle of increased operating costs. This is in clear contrast to the would-be disruptors, who typically have far lower operating costs, only buying what they need when they need it.

It doesn’t have to be that way. In fact, from our experience working with a wide variety of clients in banking and capital markets, insurance, and asset management, we think many financial institutions are spending up to twice as much as they need to on IT.

3. Build the technology capabilities to get more intelligent about your customers’ needs

Customer intelligence—and the ability to act in real-time on that intelligence—is one of the key trends affecting the financial services industry, and it will drive revenue and profitability more directly in the future. As this happens, many of the attributes that drive today's brands, from design to delivery, could become less important. By 2020, we expect that the ‘new normal’ operating model will be customer- and context-cantered. That is, companies will change the way they interact with their customers based on the context of the exchange. They will offer a seamless omnichannel experience, through a smart balance of human and machines.

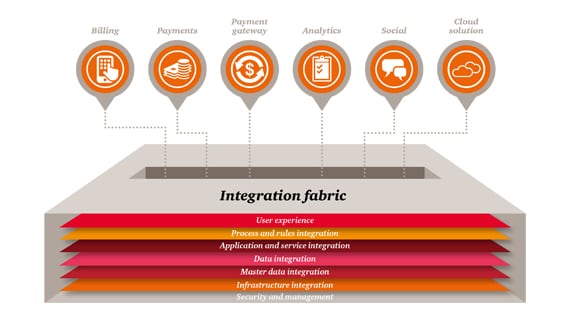

4. Prepare your architecture to connect to anything, anywhere

Here are just a few of the endpoints that will need to coexist and cooperate:

- Enterprise databases, data warehouses, applications, and legacy systems

- Cloud services

- Business-to-Business (B2B) connections, linking to comparable systems at partners and suppliers

- Business-to-Consumer (B2C) connections, linking to apps, wearables and mobile devices at an individual user level

- Bring-Your-Own-Device (BYOD) connections, using an enterprise mobility strategy to link to employees and contractors

- Third party ‘big data’ sources

- IoT sensors

The systems are diverse, and they are getting more complex by the week. Now, financial institutions will need to layer on a more sophisticated view of federated identity management, because companies will be dealing with new classes of users. Systems architecture can be the key to balancing control and accessibility. That is, the way you assemble the technical building blocks can protect your institution against cyber-threats without adding needless barriers to discourage interaction.

5. You can’t pay enough attention to cyber-security

Financial institutions have been addressing information security and technology risks for decades. But a growing number of cybersecurity “events” in recent years has shown that the traditional approach is no longer good enough. In fact, in PwC’s Global State of Information Security Survey 2016, we found that there were 38% more security incidents detected in 2015 than the year before. Many financial institutions still rely on the same information security model that they have used for years: one that is controls- and compliance-based, perimeter-oriented, and aimed at securing data and the back office. But information security risks have evolved dramatically over the past few decades, and the approach that financial institutions use to manage them has not kept pace.

6. Make sure you have access to the necessary talent and skills to execute and win

As financial institutions look to the future, one of the biggest hurdles will have nothing at all to do with technology. For years, traditional financial institutions have designed their offerings from the inside out: “this is what we will offer,” rather than “what do our customers want?” But this model no longer works. And the skills and interests of today’s IT team members and third-party talent may not be up to the challenges of tomorrow’s technical environment, where partnering with customers will be essential.

This article was sourced from the following web address: https://www.pwc.com/gx/en/industries/financial-services/publications/financial-services-technology-2020-and-beyond-embracing-disruption.html

Pfirestorm does not own or imply ownership of this article or the information included in it.

The contents of this article are sourced from third parties.There is no warranty of any kind, expressed or implied, regarding the information or any aspect of this article. We shall not be responsible for and disclaim liability for any loss, damage (whether direct or consequential) or expense of any nature whatsoever, which may be suffered as a result of, or attributable to, the use or reliance upon the information provided in this newsletter

Contact Details

| company: | pfireStorm |

| address: | 21 Alexander Drive Winston Park, Gillits |

| tel: | +27 87 474 2200 |

| fax: | +27 31 764 4090 |

| website: | https://www.pfire.co.za |

People

Company Profile

Pfirestorm is an affordable internet based service that organisations are able to offer their clients that will result in the cementing of existing relationships and/or the establishment of new relationships between the clients and the organisation.

This service is CLIENT-CENTRED and simultaneously provides the organisation with a platform that addresses fundamental business matters such as strategy and wealth creation, operations and practice management, compliance issues, day to day matters, vast Marketing opportunities, leveraging IT in a unique way, staff incentives and measurements and impact directly and indirectly on your income flows from day one.

The purpose for this service is to enable organisations and clients to be able to reach out to one another in an environment that is transparent, promotes shared responsibility and facilitates relationships providing mutual benefit for the client and the organisation.

It is no longer a matter of who you know! It is who knows YOU!

It is time!

VALUE PROPOSITION TO OUR CLIENTS

Pfirestorm’s unique collaborative technology will enable our clients to deliver a branded and unified sustainable experience to their customers at all levels of their organisation, through programmed alignment of internal procedures and processes with their Customer Value Proposition.

Our clients will experience the power of a programmed behavioral system designed to sustain, facilitate and deliver to their clients, a distinctive Customer Value Proposition resulting in increased new and retained customers that can be measured in terms of higher production outcomes, reduced operating costs, focused employee and customer activities, customer services that exceed expectations, business continuity, and ultimately good corporate governance aligned to a dynamic regulatory environment.